50+ can i deduct mortgage payments on rental property

Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. Ad Automate state and local taxes on rental properites so you can focus on guest experience.

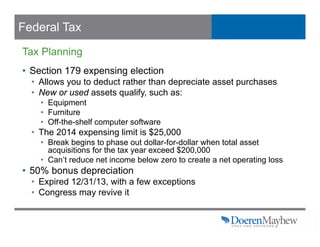

2014 Tax Update

Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings.

. Web A favorable exception to the PAL rules currently allows you to deduct up to 25000 of annual passive rental real estate losses if you actively participate and have. Compare More Than Just Rates. Web Up to 25 cash back The 5000 payment which is almost all for interest charges is not a deductible interest payment.

Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental. Heres how it works using an example property purchased for 325000 with a. Web Answer Generally deductible closing costs are those for interest certain mortgage points and deductible real estate taxes.

Find A Lender That Offers Great Service. Many other settlement fees and. Web The rental property mortgage interest deduction offers significant tax benefits.

You should have entered the property as an Asset to be. Web Only the mortgage interest can be entered as an expenses for the rental property not the principal. If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return.

Web The short answer is no. Six months later Phil pays back the 5000 loan with interest. Web What Deductions Can I Take as an Owner of Rental Property.

You cannot deduct principal mortgage payments from your income whether your real estate property is your primary residence or a rental. Web If you took out a 25 year 500000 home loan at a 29 interest rate your interest paid will total to around 200000. While the interest is a tax deduction.

This transaction just skips the cash in and out of the LLC since you. These expenses may include mortgage interest. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

Web The mortgage payment is considered a capital contribution by you and your wife as partners. Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property.

Real Property Tax Howard County

Time Needed To Close On A Mortgage Timeline From Start To Finish

Is Your Mortgage Considered An Expense For Rental Property

Guide To Passive Real Estate Investing For Retirement

9 Rental Property Tax Deductions For Landlords In 2022 Smartasset

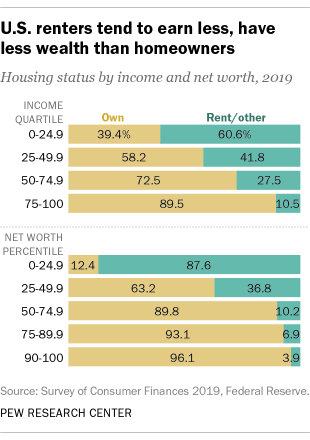

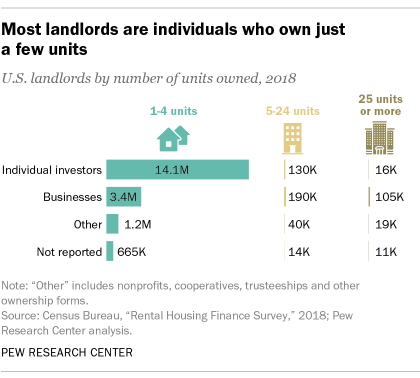

Who Rents And Who Owns In The U S Pew Research Center

Professional Athletes Foundation Money

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

What Is Considered A Second Home For Tax Purposes Pacaso

Heirs And Inherited Property Investments 1031 Crowdfunding

Buying An Apartment In Munich Does Not Make Sense Financially Today Contradict Me R Munich

Smith Manoeuvre Tax Deductible Investing 2023 Guide

Pros And Cons Of Owning A Second Home In Retirement

Is Owning A Duplex A Good Investment

Who Rents And Who Owns In The U S Pew Research Center

How To Buy A Triplex A Step By Step Guide To House Hacking An Investment Property In The Nyc Area Famvestor

At What Income Level Does The Marriage Penalty Tax Kick In